Non trucking insurance is the term for insurance that provides coverage to a person or entity who is not hauling goods. In other words, non trucking insurance is a policy that covers you if you are driving your personal vehicle.

Understand the policy: Always review your non trucking insurance policy before you hand over any money, since your insurance may not cover all risks. For instance, most policies will cover cargo theft, but not if the theft is caused by the insured’s negligence.

Review your policy annually: The policy you purchased when you purchased your truck may no longer meet your needs. For instance, you may want to extend your non trucking insurance to cover your passengers if they get injured while riding in your truck.

Pay attention to the deductible: The deductible is the amount you must pay toward a loss before it is covered by your non trucking insurance. Generally, a higher deductible means a lower premium. However, if you cause an accident with a deductible that is not high enough to fully cover the loss, you may be subject to a lawsuit.

If you’re a driver who doesn’t replace your truck every year, you probably don’t have freight insurance non trucking insurance. But what does that mean? Freight insurance non trucking insurance, or “non trucking insurance,” is a type of coverage that’s ideal for drivers who don’t replace their trucks every year. The coverage can allow you to avoid having to replace your truck every couple of years, because non trucking insurance is a type of add-on that pays for your truck’s value after a catastrophic event (like a theft, fire, or collision).

Non trucking insurance is commercial insurance for trucks that don’t haul goods.

“Non-trucking insurance” is commercial insurance for trucks that don’t haul goods. All trucking companies, whether or not they’re in the business of transporting goods, are required to carry commercial vehicle insurance. Non-trucking insurance is another vehicle insurance policy that covers trucks that aren’t transporting any goods.

A non trucking insurance policy is Commercial Automobile insurance for trucks that transport property, not people or property. Non trucking insurance is for trucking companies that do not hire or operate any trucks that transport goods. Such trucking companies are generally companies that transport people or property.

Truckers use non trucking insurance to cover any accidents involving trucks that are not hauling goods, like big rigs and other heavy vehicles.

Having proper insurance coverage is important, but making sure you have the right insurance for the type of vehicle you own is especially important for truckers. Having non trucking insurance can be complicated. Truckers are required by law to have Commercial Auto Insurance, which protects them from liabilities caused by accidents involving their trucks. This protects them in case they’re liable for damages to property or injuries to people. However, it does not cover damages to other vehicles or other property caused by non-trucking incidents.

Truck drivers are one of the largest groups of drivers who use non trucking insurance. However, many drivers don’t know that non trucking insurance is available for them. This insurance is used when a trucker is involved in a car accident that is not related to driving a truck, except for the fact that the truck was hauling goods. Non trucking insurance can cover accidents involving big rigs and other heavy vehicles, like, say, a semi truck. Non trucking insurance can also be called non trucking liability coverage, cargo insurance, or cargo liability insurance.

Non-truck insurance includes Liability, Physical Damage, Comprehensive and Collision coverages.

Truckers are required by law to carry certain commercial insurance policies, including coverage for collision, liability, and physical damage. However, some drivers may not be aware that non-truck insurance, also known as cargo insurance, is included and necessary too. Trucks are large vehicles that pose a serious risk to other motorists. When operating a truck, drivers must remain aware of their surroundings, watch for other motorists, and be prepared to stop or slow down in order to avoid potential accidents. When an accident does happen, however, drivers can be held financially responsible.

Non-truck insurance, also known as non-trucking, commercial auto, or bobtail insurance, is an add-on to a standard auto insurance policy. This policy is available to individuals or businesses who are not required to carry a commercial license or that license has been suspended or revoked. The insurance policy is designed around the terms of a specific contract. It includes the same minimum coverages as traditional auto insurance, such as liability coverage, collision, comprehensive, and medical payments.

In summary, non trucking insurance is an arrangement between an insurance company and a truck driver. The insurance company issues a policy to the driver, and in return the driver agrees to comply with certain guidelines. This policy is meant to protect the insurer by covering claims the driver might make. These guidelines can include limits on speed, hours of service, and requiring the driver to hold a commercial driver’s license.

Non trucking insurance is insurance which doesn’t cover trucks. This insurance is for those businesses that own or operate vehicles that transport goods, products, and people, but don’t use trucks. These businesses need Insurance that protects their cargo, employees, and vehicles.

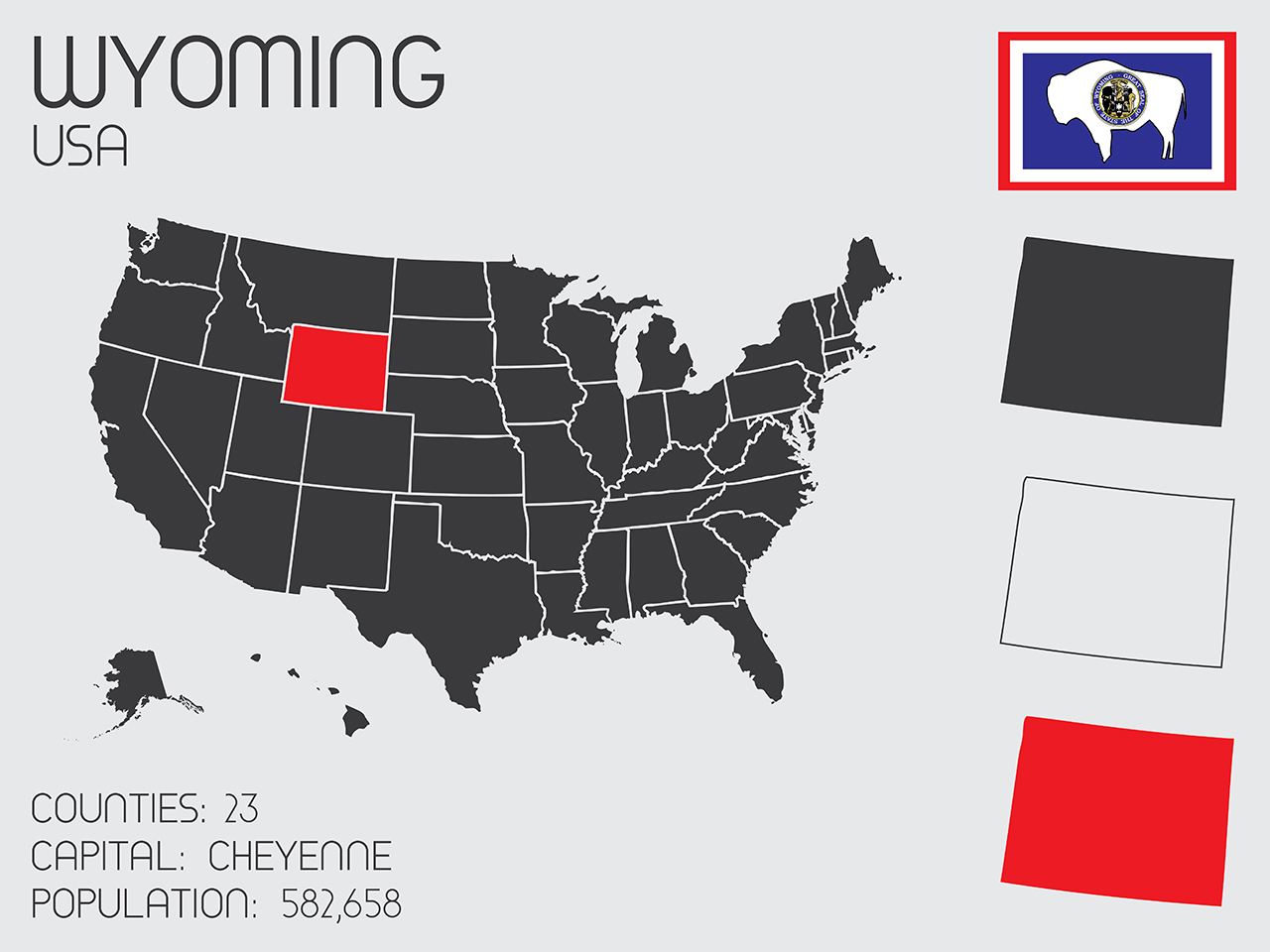

Trucks are a big part of Wyoming’s economic history. With an extensive network of highways and well-maintained roads, Wyoming has benefited from the local trucking industry for decades. And while commercial truck insurance is required in every state, the cost of truck insurance in Wyoming is more expensive than most states.

Trucks are a big part of Wyoming’s economic history. With an extensive network of highways and well-maintained roads, Wyoming has benefited from the local trucking industry for decades. And while commercial truck insurance is required in every state, the cost of truck insurance in Wyoming is more expensive than most states. Commercial trucking is a major industry in the United States, and it is growing. According to the latest data from the U.S. Department of Transportation, the number of commercial freight trucks traveling on U.S. roads is at its highest level since the late 1990s. And while this growth can be attributed to the popularity of online retail, air transportation and delivery services, the number of drivers is also rising.

Commercial trucking is a major industry in the United States, and it is growing. According to the latest data from the U.S. Department of Transportation, the number of commercial freight trucks traveling on U.S. roads is at its highest level since the late 1990s. And while this growth can be attributed to the popularity of online retail, air transportation and delivery services, the number of drivers is also rising.

The trucking industry is a huge $28 billion dollar industry in the U.S. It plays a vital role in our economy as a motor of transportation, and also provides jobs for thousands of people. Trucking holds a special place in the heart of many Americans, and protects the industry from a number of different threats.

The trucking industry is a huge $28 billion dollar industry in the U.S. It plays a vital role in our economy as a motor of transportation, and also provides jobs for thousands of people. Trucking holds a special place in the heart of many Americans, and protects the industry from a number of different threats. Whether you’re driving a company vehicle or have a single use truck, commercial truck insurance is a must. For truckers who own their own trucks, commercial vehicle insurance protects them in the event that they get into an accident. If you rent or lease a truck, your lender may require you to buy commercial truck insurance in order to get the financing. Without insurance, you would have to pay out of pocket for any damages your truck incurs.

Whether you’re driving a company vehicle or have a single use truck, commercial truck insurance is a must. For truckers who own their own trucks, commercial vehicle insurance protects them in the event that they get into an accident. If you rent or lease a truck, your lender may require you to buy commercial truck insurance in order to get the financing. Without insurance, you would have to pay out of pocket for any damages your truck incurs.

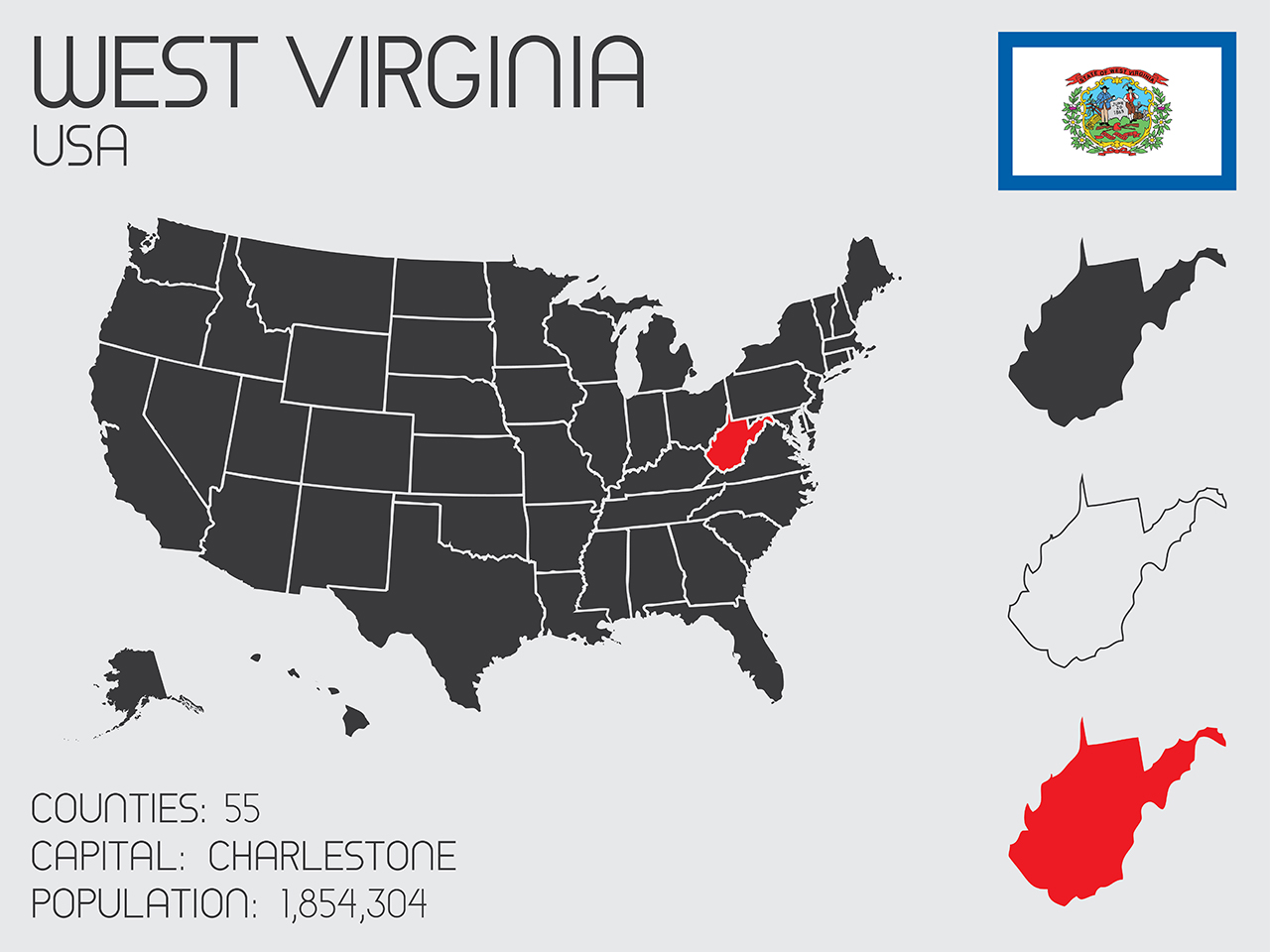

If you own a commercial truck in West Virginia, you may be required to carry commercial truck insurance. Commercial truck insurance has a number of different policies and coverage options—making it important to find a policy that best fits your business and its unique needs.

If you own a commercial truck in West Virginia, you may be required to carry commercial truck insurance. Commercial truck insurance has a number of different policies and coverage options—making it important to find a policy that best fits your business and its unique needs.

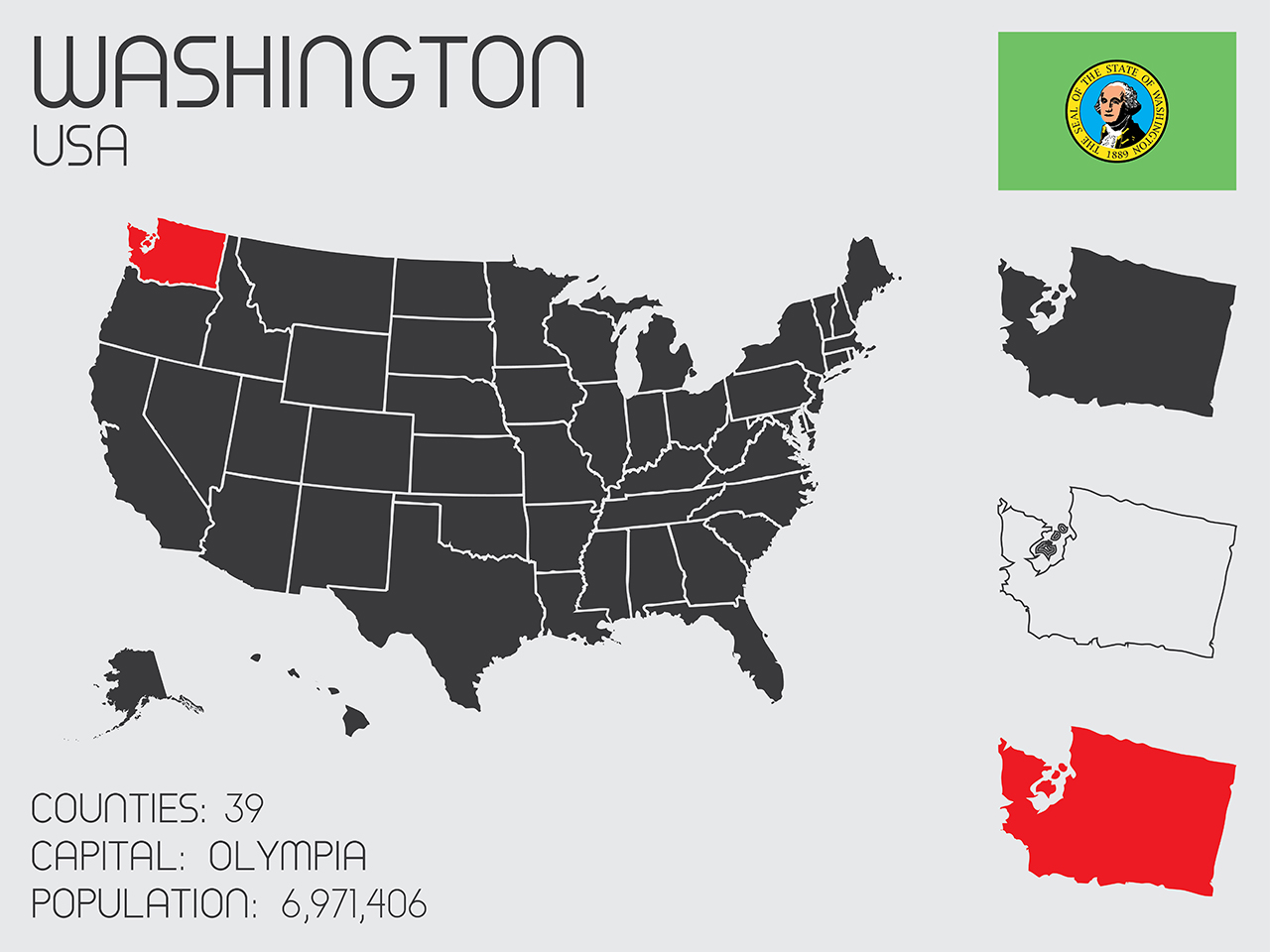

Washington commercial truck insurance is highly specialized, so you want to work with an agent who has the knowledge and experience needed to handle your business’s specific coverage needs. Commercial truck insurance in Washington covers vehicles used for hauling cargo, transporting people, or both. Businesses with fleets of vehicles can choose from coverage options that include liability, collision, cargo, or physical damage coverage, as well as additional coverage for their personal auto policies.

Washington commercial truck insurance is highly specialized, so you want to work with an agent who has the knowledge and experience needed to handle your business’s specific coverage needs. Commercial truck insurance in Washington covers vehicles used for hauling cargo, transporting people, or both. Businesses with fleets of vehicles can choose from coverage options that include liability, collision, cargo, or physical damage coverage, as well as additional coverage for their personal auto policies.